Posts

If your losings are a result of an excellent casualty inside the a federally stated emergency, understand the recommendations to own Plan An excellent (Form this link 1040), line 15. Should your Setting 1099-K erroneously accounts reimbursements private expenses, report the quantity to the both Plan 1 (Function 1040), lines 8z and you may 24z. To learn more from the Mode 1099-K, understand the Instructions to possess Payee provided thereon form and regularly questioned concerns or any other information at the Irs.gov/1099K. The details are identical as with Analogy 2, but zero taxes was taken out of both mate’s shell out. But not, it file a shared go back to allege a western chance credit from $124 and now have a refund of the number. As they submitted a joint go back stating the fresh Western possibility borrowing, they aren’t submitting it just to get a reimbursement of income income tax withheld otherwise estimated income tax paid.

Wells Fargo Prominent $step three,five hundred Bank otherwise Spending Bonus (Demands $250k-$500k In the Cash/Assets)

You ought to use in your earnings, at that time acquired, the brand new fair market value out of possessions or characteristics you get inside the bartering. For those who replace services which have another individual and also you both have arranged ahead of time on the value of the services, you to well worth might possibly be accepted as the fair market value unless the brand new well worth will be proven to be if not. In the event the strategy step one leads to reduced income tax, take the itemized deduction for the Plan A great (Setting 1040), range 16. If strategy dos causes shorter income tax, claim a cards for the number away from step 2c above for the Plan 3 (Mode 1040), range 13z.

Waiting till you journey a yacht for the first time…. (Now…. I’m to shop for a 50’ Awesome Super Yacht!)

If you found salaries or wages, you could stop paying estimated tax from the inquiring your employer when deciding to take far more tax from your earnings. For those who discovered ill pay lower than a collaborative negotiating contract ranging from the union and your company, the brand new contract can get dictate the amount of tax withholding. See your partnership member otherwise your employer for more information.

Come across Thinking-Working Persons inside the chapter 1 to possess a dialogue of when you’re also felt mind-working. Don’t use in your earnings number you will get regarding the guests to own driving a car in the a carpool both to and from works. This type of amounts are believed compensation for your expenses.

The $125 no-deposit added bonus so is this web site’s flagship totally free prize. Census Agency as the an enhance to the present Inhabitants Questionnaire. The family Questionnaire gathers details about family savings ownership or any other financial products and you may features one houses are able to use to meet the exchange and you may borrowing from the bank requires. The newest nationally associate questionnaire is given to help you just as much as 31,100 You.S. households and you may production results that will be affiliate for the 50 claims and the District out of Columbia.

For those who lease a vehicle, vehicle, otherwise van that you apply in your team, you need to use the high quality usage rates otherwise real costs to figure your deductible costs. That it point shows you simple tips to profile actual expenditures to have a leased car, vehicle, or van. Through the 2024, you used the automobile 29% to own company and you will 70% private motives. In the June 2021, you purchased a vehicle to own exclusive include in your business. Your satisfied more-than-50%-have fun with try to the very first 3 years of your recovery months (2021 thanks to 2023) however, did not see it from the fourth year (2024).

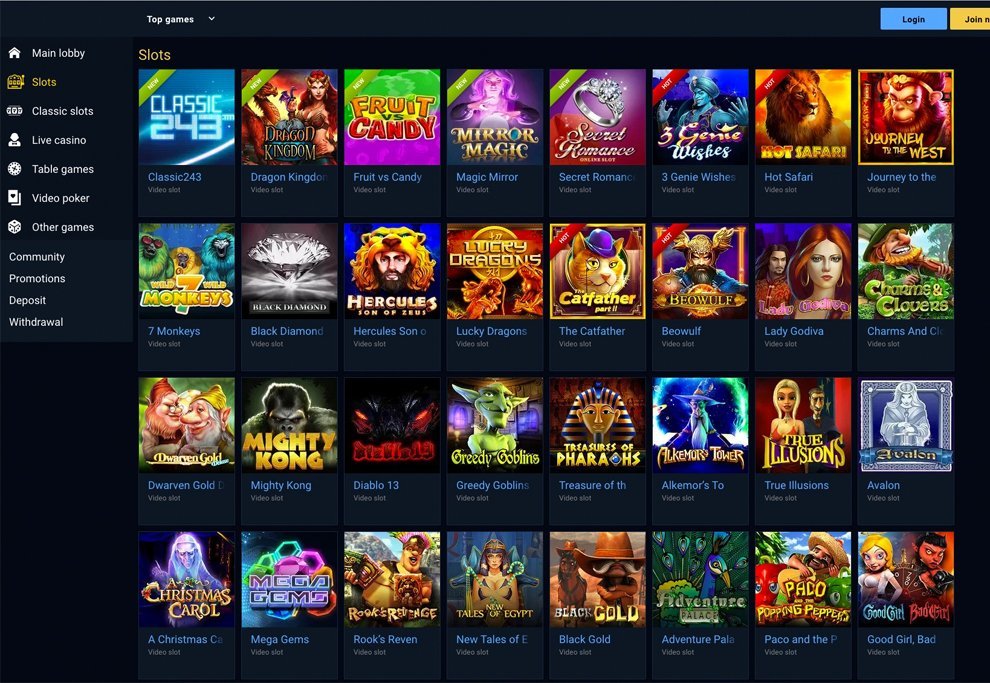

You might carry it inside cash or since the fifty totally free revolves to your any casino slot games they’ve chosen to promote when you see. Those people free spins is $1 for each and every, so the cash is actually the same, it simply relies on the manner in which you invest they. Harbors Kingdom started providing casino games and you can harbors on line in the 2019.

When you subtract your own tax credits, see whether you can find some other taxation you must shell out. Understand the following the listing for other taxes you may need to enhance your income income tax. To own information on how so you can deduct your repayments of specific personal shelter pros, discover Money Over Disgusting Professionals inside the a bankruptcy proceeding.

Table step one-5. When to File Your 2024 Go back

However, in case your refund actually made inside forty five days after you document the brand new amended return, attention was paid up for the day the fresh reimburse are paid back. If you file a state for starters of the things that inside the list following, the brand new schedules and you will limits mentioned before might not apply. These products, and you can where to get more information, are as follows. Or even file a state inside months, you do not be entitled to a card otherwise a refund. Whenever finishing Function 1040-X, don’t neglect to tell you the year of your unique go back and you will determine all of the changes you have made. Be sure to attach one versions otherwise schedules wanted to define their alter.

The brand new co-holder whom redeemed the text is a good “nominee.” Come across Nominee withdrawals less than Tips Report Attention Earnings in the Pub. 550, chapter step 1 to learn more about how precisely a person who is a great nominee accounts focus earnings belonging to another person. If you purchase a bond for a cheap price whenever desire have been defaulted otherwise if interest has accrued however, wasn’t paid, the transaction is described as change a thread apartment. The new defaulted or outstanding attention isn’t income and you will isn’t taxable as the attention if the paid back later. After you discover an installment of these interest, it’s an income from money you to decreases the leftover costs basis of one’s bond. Attention one to accrues following time out of purchase, although not, is actually nonexempt attention earnings to the 12 months it is received or accumulated.